Breaking News

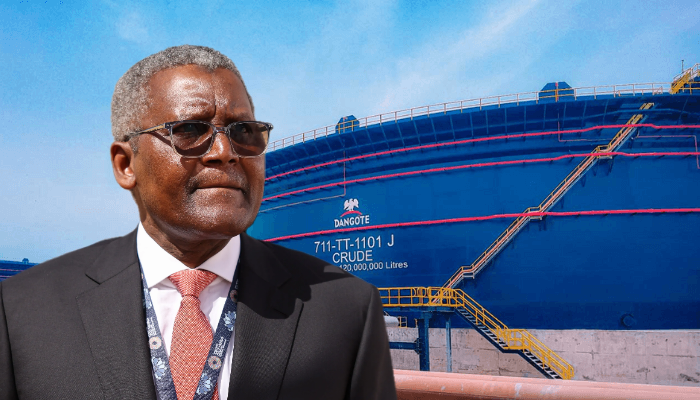

BREAKING NEWS: Dangote Petroleum Refinery has temporarily halted the sale of petroleum products in Naira.

Dangote Petroleum Refinery has temporarily stopped selling petroleum products in Naira, opting instead for transactions in U.S. dollars. This decision comes amid ongoing currency fluctuations and economic concerns in Nigeria. The move is expected to impact fuel marketers and businesses that rely on local currency transactions.

The refinery, which began operations recently, had initially allowed payments in Naira but has now shifted to dollar-based sales. The decision aligns with Nigeria’s broader economic challenges, particularly the depreciation of the Naira against foreign currencies. The refinery’s choice to trade in dollars is seen as a response to the instability of the local currency, which has made pricing and financial planning more difficult.

Sources indicate that the refinery’s decision is primarily driven by the need to ensure financial sustainability and manage foreign exchange risks. The cost of crude oil, which the refinery imports, is typically priced in dollars. By accepting payments in foreign currency, Dangote Refinery can better manage its expenses and maintain operations without being affected by fluctuations in the Naira’s value.

The policy shift has raised concerns among local fuel marketers and businesses that rely on the refinery for supplies. Many of these businesses conduct transactions primarily in Naira, and the requirement to pay in dollars could create financial strain. Some industry stakeholders worry that this could lead to higher fuel prices in Nigeria, as marketers may struggle to access sufficient foreign exchange to purchase products.

The Central Bank of Nigeria (CBN) has been working to stabilize the Naira, but foreign exchange shortages continue to pose challenges. The country’s dependency on imports for refined petroleum products has long been a problem, and Dangote Refinery was expected to ease these pressures. However, its move to dollar-based transactions could complicate efforts to ensure stable fuel pricing in the local market.

Government officials and economic experts are closely monitoring the situation. There are discussions on whether regulatory measures might be introduced to address the impact of this policy change. The Nigerian National Petroleum Company Limited (NNPC), which plays a significant role in the country’s fuel distribution, has not yet commented on the development.

Dangote Refinery, one of Africa’s largest private refineries, was built with the goal of reducing Nigeria’s reliance on imported fuel. The refinery has the capacity to refine up to 650,000 barrels per day and was seen as a solution to the country’s fuel supply challenges. Its shift to dollar-based transactions raises questions about how fuel pricing will be managed in the future.

Analysts suggest that if the refinery continues selling only in dollars, it could further impact Nigeria’s fuel market and inflation rates. Consumers may face rising fuel costs, especially if marketers struggle to secure dollars for purchases. This could, in turn, affect transportation costs and the prices of goods and services across the country.

The situation remains fluid, with industry players and government officials assessing possible solutions. While some believe the refinery’s move is necessary to maintain its financial stability, others argue that it could add to the economic hardships faced by Nigerians. Observers are waiting to see if the government will step in to mediate or introduce policies to mitigate the impact on local fuel distribution.