Business

Customer Suspects Bank Insider in the Disappearance of N220,818 From His Account, UBA Says No Refund

Agency Report

George Ndu, a United Bank for Africa (UBA) customer, has accused his bank of refusing to refund his N220,818 after suspected insider theft.

Ndu told FIJ that at 5:03 pm on September 12, he had received multiple debit alerts totalling N220,818.

“I was at my place of work when the incident happened. The first debit alert came at three minutes past five, the second at six minutes past five, the third one came at nine minutes past five, and continuously like that. Before I got to my house, the whole money had gone,” Ndu said.

“The next day, I went to the bank as early as 8 am. I reported the incident to the bank manager. They asked me if I was using any ATM card or the mobile banking app for transactions, and I told them I had neither the ATM card nor the mobile banking app.”

Ndu, who was told to come back on September 28 after the matter had been investigated, sought the help of Okoh Uboh & Co Legal Practitioners for legal intervention.

“My lawyer told me that two weeks was too much for the bank. He told me it was a case they should be able to resolve in one week, and that they were just looking for a way to manipulate everything,” Ndu said.

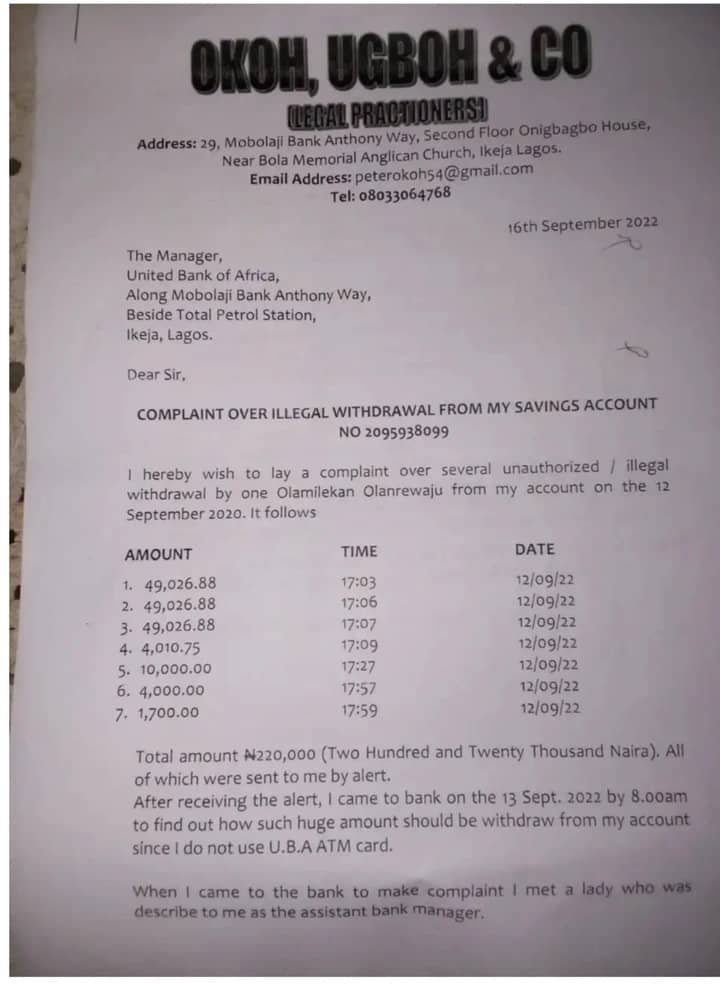

A LAWYER’S INTERVENTION

In a letter to the manager of the UBA branch at No 22, Mobolaji Bank Anthony, Ikeja, dated September 16 and titled “Complaint Over Illegal Withdrawal From My Savings Account No 2095938099”, Peter Okoh Uboh Esq pointed out that the customer care representative did not treat his client (Ndu) with “any sympathy and willingness to address the compliant with the seriousness it deserves”

“Accordingly, we are hereby giving the bank seven or one week to resolve this illegality and credit our client with the stolen money in addition to damages, lose of income plus because of you action,” the lawyer wrote UBA.

“Please take further note that if we do not hear favourably from you within seven days, I shall be left with no choice than to issue public notice across the nation to warn Nigerians of the danger of banking with UBA as a result of the prevalence of fraudsters within the UBA banking system.”

FIJ spoke with lawyer Uboh, who said, “The issue is that my client’s account was hacked; they cleaned up his account. We wrote to the head office, giving them seven days to reverse the money but they never responded. We are suspecting that it is an insider job. Instead of them to do their proper investigation, they are trying to tell my client that he was careless.”

“We have even written to the CBN. If the CBN does not respond, we will go to court. My client has a savings account; he does not have any ATM card, which the bank says he used to withdraw his money. They are saying he withdrew everything he had in his account. If we don’t hear anything from CBN, we are going to sue them. It is an insider fraud.”

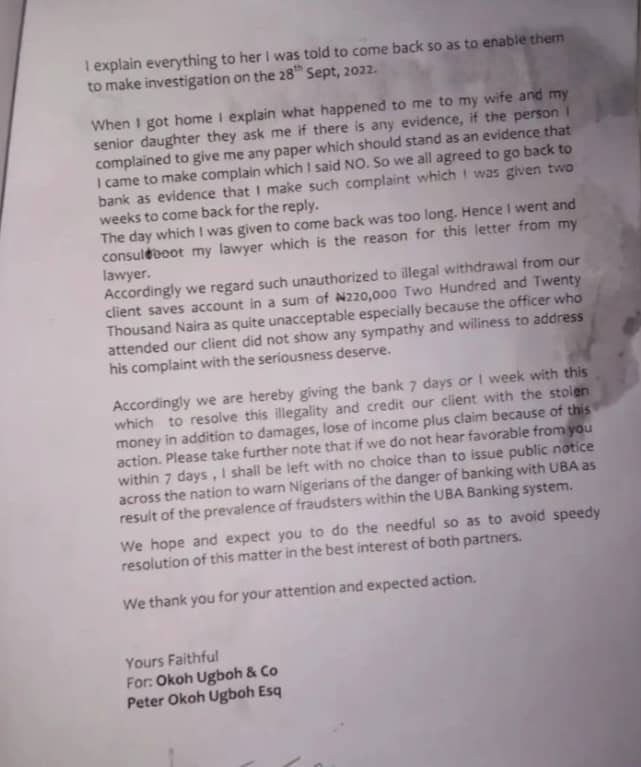

On October 17, lawyer Uboh wrote another letter to the UBA branch manager, copying the Central Bank of Nigeria (CBN) and the managing director of the bank.

“We are shocked beyond measure that four weeks after you received that letter, you never deemed it appropriate, necessary and auspicious to tender any response to the said letter. Whatsoever and howsoever, this is a display of arrogance and unacceptable impunity by your bank, which is becoming an irresponsible bank to your customers,” the lawyer wrote.

UBA ‘NEITHER NEGLIGENT NOR LIABLE’

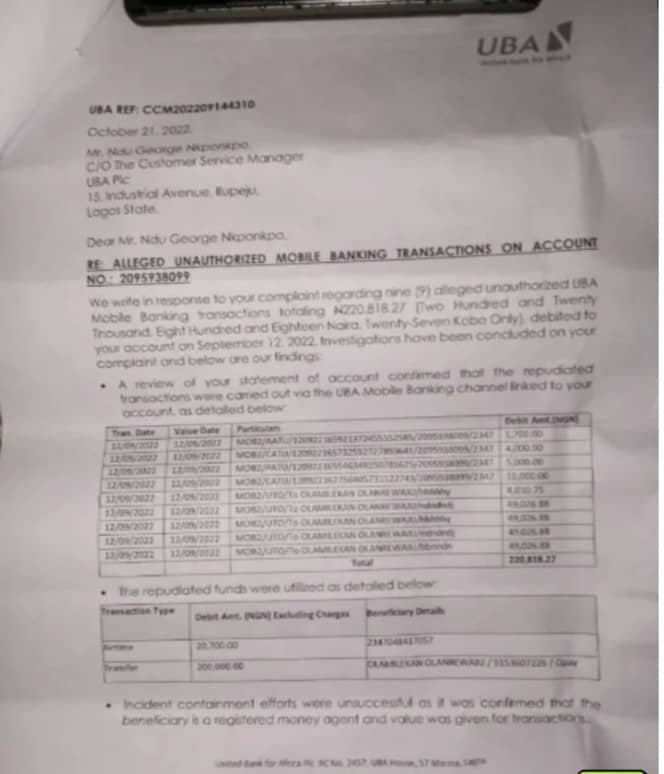

Eventually, on October 21, UBA replied that a sum of N220,818 was transferred via the mobile banking app by Ndu to Olamilekan Olanrewaju and, as such, the “United Bank for Africa Plc was neither negligent nor liable”.

The bank also told Ndu’s lawyer Uboh that it would not be responsible for the N220,818 “because the transactions were carried out with your client’s valid credentials and duly validated with sensitive authentication data known to your client alone”.

The bank wrote that sums of N200,000 and N20,700 had been utilised for transfer and airtime respectively by Olanrewaju.

“Consequently, the bank is not in a position to refund the sums withdrawn with your client’s confidential details, including his pin,” UBA wrote.

Meanwhile, FIJ reached out to Ndu’s bank manager on the phone, who said she did not know any one bearing George Ndu, adding that FIJ should go to the bank to find out.

“I am not the bank manager. I am the bank’s operations manager. I don’t even know anyone bearing George Ndu. You can always go to the bank to verify. Thank you,” she said.

FIJ also spoke with two UBA’s customer care representatives with respect to Ndu’s missing N220,818 on the phone.

One of them, while acknowledging that a sum of N220,818 had been debited from Ndu’s account on September 12, said an ongoing investigation on the matter would be completed on November 26.

The other customer care representative said Ndu must have given his bank details out to a stranger who could have operated on the account, and that “getting his money back is slim”.

-

Politics2 days ago

Politics2 days ago$35M Atlantic Refinery Project: Sunny Goli Commend Tinubu, EFCC over Diligent Prosecution

-

Politics2 days ago

Politics2 days agoAlleged N101.4 Billion Fraud: Court Orders Service of Hearing Notice on Yahaya Bello

-

Politics2 days ago

Politics2 days agoConfusion As Court Adjourns Appeals On Rivers State Political Crisis, Orders PDP To Clarify Legal Representation

-

Politics2 days ago

Politics2 days agoEdo State Govt Bans Activities Of Drivers On Wheels And Road Transport Employees Association Of Nigeria (RTEAN).

-

Niger Delta6 days ago

Niger Delta6 days agoPAP Has Been Beneficial But Budget Increment Is Long Overdue—Ex- Agitator

-

News2 days ago

News2 days agoKAI demolishes 138 Shanties, dislodges 169 illegal residents in Lagos

-

Politics5 days ago

Politics5 days agoAppeal Court President Sets Up Special Panel to Address Rivers State Political Crisis

-

News2 days ago

News2 days agoPolice Cracks Down Criminal Syndicates, Apprehend 82 suspects in Kano