News

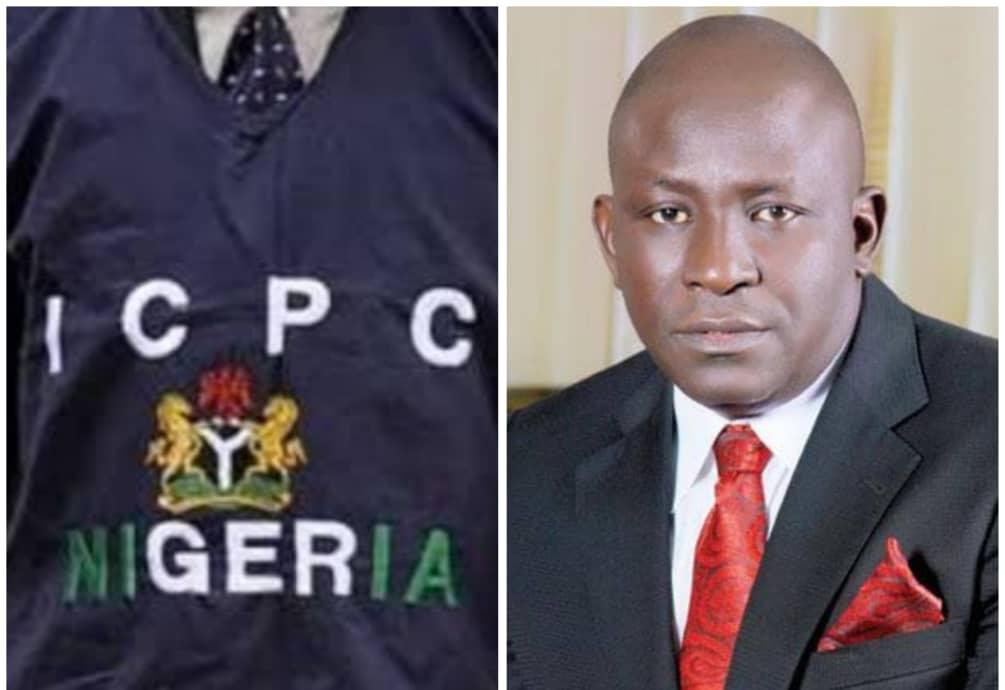

ICPC to arraign ex-CEO of Federal Mortgage Bank, others over alleged $65 million real estate fraud in Abuja

***Allegations include awarding a contract to an allegedly incompetent firm and misappropriating funds.

***The multi-billion project remains incomplete, with the accused insisting the allegation is a political witch hunt.

The Independent Corrupt Practices and Other Related Offences Commission (ICPC) will arraign a former Chief Executive Officer of the Federal Mortgage Bank of Nigeria (FMBN), Mr. Gimba Kumo Yau for allegedly awarding a $65,000,000 real estate contract to an allegedly incompetent firm, Good Earth Power Nigeria Limited in 2012.

READ ALSO: EFCC, ICPC Cannot Tackle Corruption In Nigeria – Tunde Bakare

This is contained in ICPC’s charge sheet marked FHC/ABJ/CR/333/24, and filed on July 9, 2024, by Dr. Osuobeni Ekoi Akponimisingha, Assistant Chief Legal Officer, ICPC.

Yau, Bola Ogunsola, Mr.Tarry Rufus, Good Earth Power Nigeria Limited and T.brend Fortunes Limited are sued before the Federal High Court, Abuja for their alleged contravention of the Public Enterprises Regulatory Commission Act and Section 19 of the Money Laundering (Prevention and Prohibition) Act, 2022.

ICPC’S CASE

In the five-count charge obtained by Track News online on Wednesday, the anti-graft agency accused Yau of making payment to Good Earth Power Nigeria Limited in the sum of N3,785,000,000.00 out of the total contract sum of $65,000,000, for the development of 962 Units of Residential Housing in Kubwa, Abuja named “Goodluck Jonathan Legacy City” contrary to accepted practice.

The ICPC maintains that the former bank CEO allegedly contributed to his organisation’s failure at the time by approving $65,000,000 to a firm that could not carry out and complete the real estate project.

The allegations stated that Mr. Gimba Kumo Yau and Bola Ogunsola, in their roles as Chief Executive Officer and Executive Director of the bank in August 2012, had secured a loan of N14 billion from Ecobank Nigeria PLC on behalf of the bank.

This loan was said to be earmarked for the development and completion of 962 residential housing units in Kubwa, Abuja, named “Goodluck Jonathan Legacy City,” within 18 months.

ICPC further alleged that Mr. Gimba Kumo Yau, as the bank’s CEO awarded the $65 million contract despite knowing that the company lacked the capacity to carry out the contract.

ICPC added that the project remains incomplete as of today thereby amounting to “economic adversity” for the bank and in violation of Section 68(1) of the Public Enterprise Regulatory Commission Act, CAP P39, Laws of the Federation, 2004.

The other defendants were accused of giving and receiving $3,550,000.00 of the contract sum in cash in contravention of the Money Laundering Act.

Tarry Rufus, Good Earth Power Nigeria Limited and T-Brend Fortunes Limited were accused of directly converting the sum of N991,399,255 into $3,550,000.00 and handing over the same to one Jason Rosamond (now at large) in cash, contrary to Section 18(2) (b) and punishable under Section 18 (a) of the Money Laundering (Prevention and Prohibition) Act, 2022.”

The Public Enterprise Regulatory Commission Act forbids an official from taking steps that will cause an enterprise to fail, with penalties involving jail terms.

Track News Online gathered that a date had not been fixed for arraignment.

The defendants are innocent in the eyes of the law unless proven guilty by the courts.

Gimba Kumo exonerated in the past – Lawyer

Kumo’s lawyer, Barrister Okpara Orji confirmed to Track News online that his client was invited by anti-graft agencies some years back but was allegedly exonerated by its top investigators.

“The EFCC investigated the matter and they could not find anything linking Kumo.

“He was declared wanted by ICPC and we threatened to sue. They called him and pleaded; we have all those records,” Orji said.

Orji then alleged that the federal government institution was using a political witch hunt against his client.

“If they file any charge, immediately the matter is dismissed, we are going file for malicious prosecution because there is nothing linking Gimba in that matter.

“The director, of legal in ICPC, Henry Emore had said there is no charge against this man. So if they file any charge now, it is of political interest,” the lawyer claimed.

BACKSTORY

In 2021, the ICPC had declared Tarry Ruffus, Mr Gimba Yau Kumo and Mr Bola Ogunsola wanted in connection with issues relating to the diversion of public funds for real estate to the tune of $65 million.

The ICPC, in a statement on its website dated August 29, 2021, said that it recovered N53 billion from a real estate developer for the Federal Mortgage Bank of Nigeria.

Former Chairman of ICPC, Prof. Bolaji Owasanoye had disclosed during a meeting with the House of Representatives Ad-hoc Committee Investigating the Operations of Real Estate Developers in FCT, at the time.

According to him, the developer took the money without providing houses for its subscribers.

The senate committee on public accounts had also summoned Mr Kumo over the irregular award of N3 billion contract under his leadership.

The summons was based on a 2015-2018 report by the office of the auditor-general of the federation (AuGF) against the bank.

Kumo had reportedly told the ICPC that he had nothing to hide following its allegations.

-

Politics7 days ago

Politics7 days agoJUST-IN: George Turnah Welcomes Isaac Amakuro’s Disassociation from G-House Political Family

-

Business2 days ago

Business2 days agoAn Open Appeal To The Gov. Of Bayelsa State, Sen. Diri Douye Regarding The Removal Of My Prominent Billboard On Azikoro Road, Near Ekeki Park.

-

News3 days ago

News3 days agoPolice have arrested three suspects who offered a pregnant woman N30 million to terminate her six-month-old fetus for a ritual in Niger State

-

Crime7 days ago

Crime7 days agoWhy I Butchered Student I Met on Facebook – Kwara Cleric

-

Gist2 days ago

Gist2 days agoA housewife in Bauchi has stabbed her husband to death during a dispute over child custody

-

Politics5 days ago

Politics5 days agoBreaking News: The Federal High Court has ordered PDP to go ahead with its South-South Zonal Congress

-

Politics6 days ago

Politics6 days agoRivers Crisis: Eze Warns Tinubu That Posterity Will Judge Him If Fubara Is Humiliated

-

Politics2 days ago

Politics2 days agoTension in Osun: LG Workers Stand Their Ground, Defy APC’s Resumption Order